Home Affordability in the USC Area

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

Variable Definitions:

The Mortgage Status variable examines the owner-occupied housing units in an area, classifying units as either having a mortgage attached to them, or owned “free and clear” (with no mortgage). A mortgage “refers to all forms of debt where the property is pledged as security for repayment of the debt, including deeds of trust; trust deeds; contracts to purchase; land contracts; junior mortgages; and home equity loans” (American Community Survey).

Source:

American Community Survey, 5-year estimates, Table B25081

Years Available:*

2011 – 2023

*Note: Each year of available data shown above is a 5-year estimate, or an average of data collected over a five year period. 5-year estimates are used to increase the reliability of the data at small geographies like neighborhoods and census tracts. The years shown on the NDSC map represent the final year of the five year average (e.g. “2010” represents 2006-2010 data, “2011” represents 2007-2011 data, and so on). For the most impactful comparison of data over time, the ACS recommends comparing non-overlapping years (e.g. 2010-14 with 2015-19).

Mortgage status presents the share of homeowners who have any form of debt where the property is used as collateral for repayment of said debt. These debts can include home equity loans (a one-time installment loan), multiple mortgages, contracts, and trust deeds. Understanding the portion of homeowners that outright own their homes can be useful for determining the cost of homeownership and the housing needs of the community.

Mortgages allow individuals and business to buy real estate through a loan, and their terms are typically at 15 or 30 years. Mortgages can be essential for homebuyers who are unable to purchase homes with cash. This is crucial when considering the fact that homeowners have continued to gain equity on their homes and build wealth compared to renters. Although there are disparities within homeowner groups, namely within lower-income and Black households, most owners have seen an equity increase of $100,000 over the last 10 years.

Having a paid off mortgage, whether it is done early or through the end of the loan term, is beneficial for long-term financial prospects. Potentially the most important of these aspects is security during unstable housing markets or economic downturns. Homeowners without a mortgage are at no risk of foreclosure since there is no loan or lien placed on their property. Paying off one’s mortgage also frees up capital to pay off other debts or pursue other financial ventures, such as investment.

Homeownership has historically been an effective way to build wealth. The wealth disparity between renters and homeowners is largely driven by housing wealth, which has been steadily increasing and further driving the two groups apart. Homeowners are also able to save more when compared to renters, and it can be presumed that homeowners without a mortgage may be able to save the most (compared to those with a mortgage).

Written by Caroline Ghanbary

Citations:

Choi, J. H., & Zinn, A. (2024, April 19). The Wealth Gap between Homeowners and Renters Has Reached a Historic High. Urban Institute. Link.

Haury, A. C. (2023, July 30). Benefits of Paying Off Your Mortgage. Investopedia. Link.

Kagan, J. (2024, July 19). What Is a Mortgage? Types, How They Work, and Examples. Investopedia. Link.

Tracey, M. D. (2023, April 18). Study: Homeowner Wealth Is 40 Times Higher Than Renters. National Association of Realtors. Link.

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

According to the Economic Policy Institute (EPI), 8.4 million jobs have been lost since the start of the pandemic in February 2020, and over 5 million people

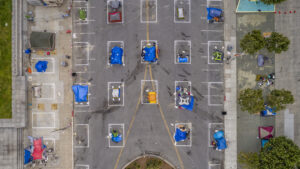

Across the nation, the population experiencing homelessness is getting older. The end of the Baby Boomer generation (those born between 1955 and 1964) have faced