Home Affordability in the USC Area

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

Variable Definitions:

Count of Units in Subsidized Properties (by program or administrative agency):The estimated total number of rental units in properties that receive at least one federal or state subsidy or program. This count includes unassisted units, such as manager units, market-rate units, etc.

Total Number of Rental Units: the total number of housing units that are occupied by renter families, and vacant rental units

Share of Rental Units in Subsidized Properties (by program or administrative agency): the count of units in subsidized properties divided by the total number of rental units in a given area

The indicators are available for the following programs:

Sources:

Data calculated and processed by Jiaqi Dong, Ph.D. student in Urban Planning and Development. Original data pulled from the following sources:

American Community Survey (ACS), 5-year estimates, Table B25003 and B25004.

Years Available:

2025

Methodology Note:

The original data comes at the address level. Our team geocoded the locations to generate X/Y coordinates, then spatial joined each point to 2020 Census Tracts.

A single property may utilize multiple subsidies and/or programs for affordable housing development or preservation. Therefore, it is advised against to sum the indicators across programs, as this may lead to double-counting.

For Los Angeles County, subsidized housing is a small but critical part of the overall housing system. After decades of underbuilding, the region now faces a severe mismatch between housing need and supply, which especially for low and moderate-income renters. Currently, Los Angeles has one of the weakest links between rising demand and new housing construction among major U.S. metros, meaning that even when rents climb, new units are slow to follow (Baum-Snow & Han, 2024; Gyourko & Krimmel, 2021). Beginning in the 1970s, the federal government shifted away from public housing and toward more complex, tax-credit–based financing, while Proposition 13 limited local revenue needed to support new development (Congressional Research Service; Legislative Analyst’s Office, 2015). At the same time, construction and land costs rose faster than incomes, making it extremely difficult to produce housing that low-income renters can afford without subsidy (Ward & Schlake, 2025). However, the need is far greater: state housing goals require more than 340,000 new affordable units by 2029, and countywide estimates show a shortfall of over 578,000 rental homes for households earning below 50% of area median income (SCAG, 2021; California Housing Partnership, 2025). In this context, subsidized housing is essential for addressing affordability because it creates units the private market cannot build and provides long-term rent stability for the county’s lowest-income residents.

Los Angeles County’s subsidized housing stock is supported through federal and state programs, each created to meet different financing and affordability needs. Federal programs administered by the U.S. Department of Housing and Urban Development (HUD)—including FHA-insured multifamily loans and project-based Section 8 contracts—primarily reduce development and operating risk or directly subsidize rents for low-income households (HUD, “Multifamily Housing Programs”; HUD, “Project-Based Rental Assistance”). State programs add an additional layer: the California Housing Finance Agency (CalHFA) provides below-market loans and tax-exempt bond financing for affordable multifamily projects (CalHFA, “Multifamily Programs”), while the California Department of Housing and Community Development (HCD) funds capital-intensive development through programs such as the Multifamily Housing Program (MHP), HOME, and supportive housing initiatives (HCD, “Multifamily Housing Program”; HCD, “Affordable Housing and Sustainable Communities”). Among all programs, the Low-Income Housing Tax Credit (LIHTC) remains the dominant driver of affordable housing production nationally and statewide, supporting the majority of income-restricted units built since the 1990s (IRS & HUD, “LIHTC Database”; NLIHC, “The Affordable Housing Gap”). Because properties often rely on layered financing that combines multiple subsidies to remain financially viable, many developments appear under several programs simultaneously (GAO, “Fragmentation and Overlap in Housing Programs”). As a result, the subsidized housing landscape reflects an overlapping set of funding mechanisms that collectively shape the region’s affordable housing supply.

Written by Katherine Ding

Citations

Baum-Snow, N., & Han, L. (2024). The microgeography of housing supply. Journal of Political Economy, 132(6), 1897–1946. Link

California Housing Partnership. (2025). Los Angeles County 2025 affordable housing needs report. Link

Southern California Association of Governments. (2021). Regional Housing Needs Assessment (RHNA) allocation plan. Link

Ward, J. M., & Schlake, L. (2025). The high cost of producing multifamily housing in California: Evidence and policy recommendations (RAND Report RRA3743-1). RAND Corporation. Link

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

According to the Economic Policy Institute (EPI), 8.4 million jobs have been lost since the start of the pandemic in February 2020, and over 5 million people

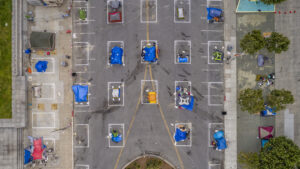

Across the nation, the population experiencing homelessness is getting older. The end of the Baby Boomer generation (those born between 1955 and 1964) have faced